2023 most certainly is a shifting climate from 2022 and 2021.

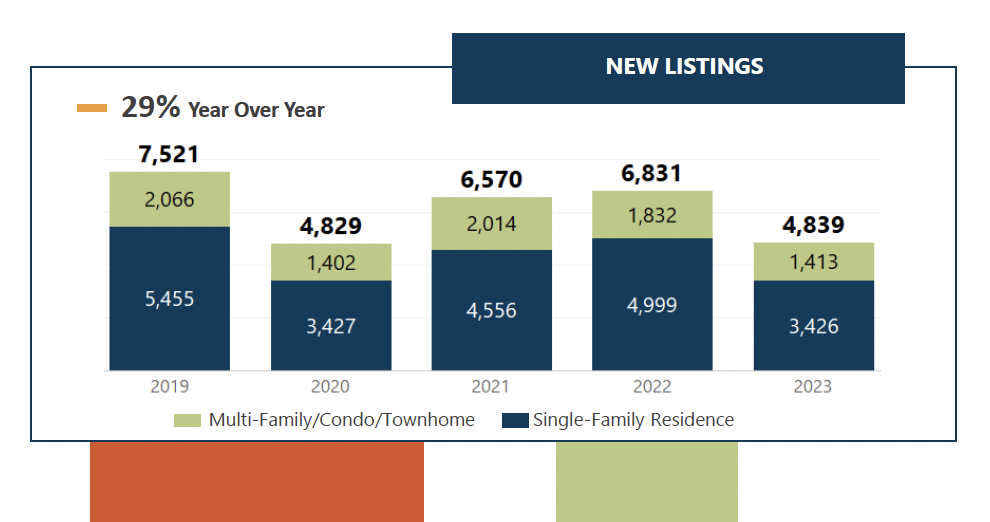

The highlights of the first four months are as follows:

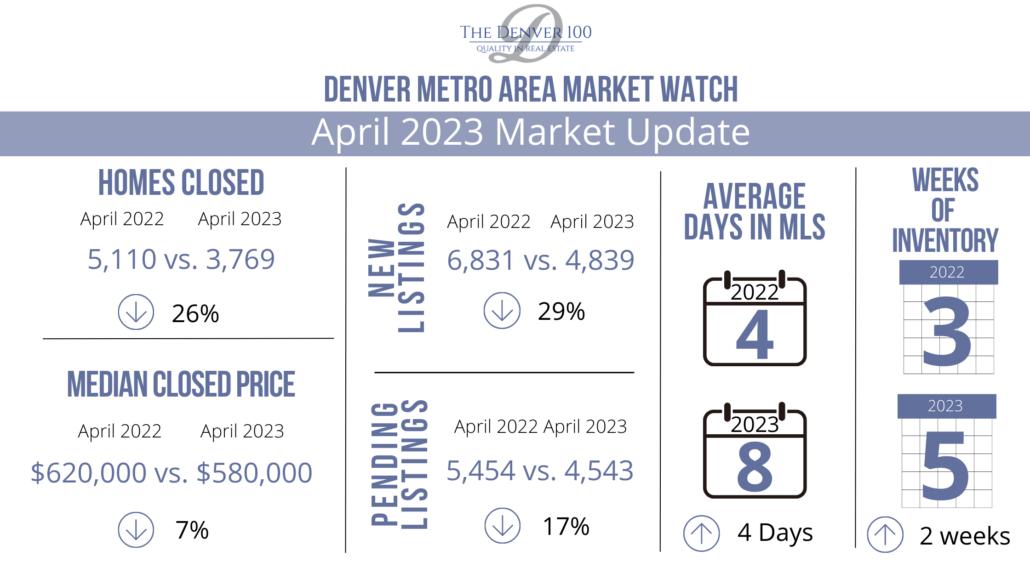

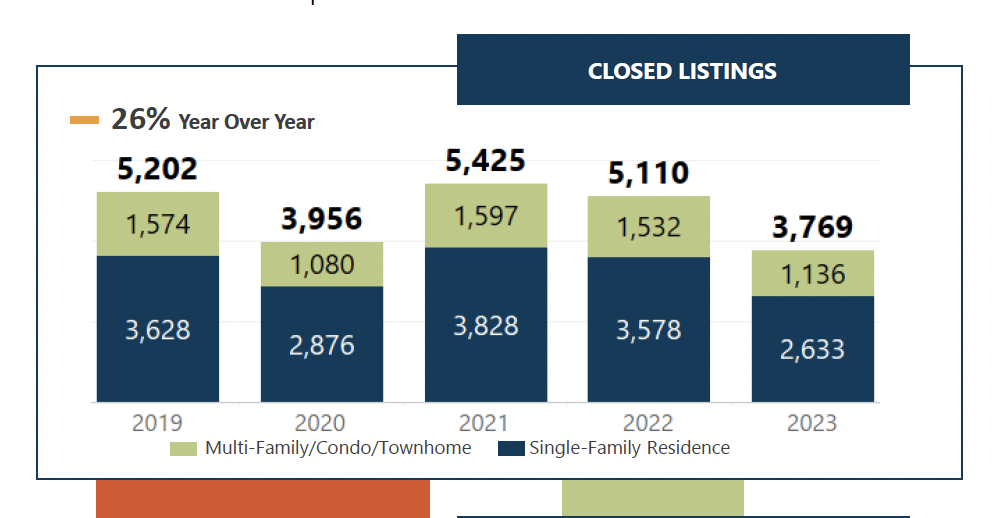

- Listings Sold are down 26.2% in 2023 from 2022.

- Median Price of Homes Sold in 2023 is down 7% from 2022.

- Active Inventory has risen 46.5% from May 16, 2022 to May 15, 2023.

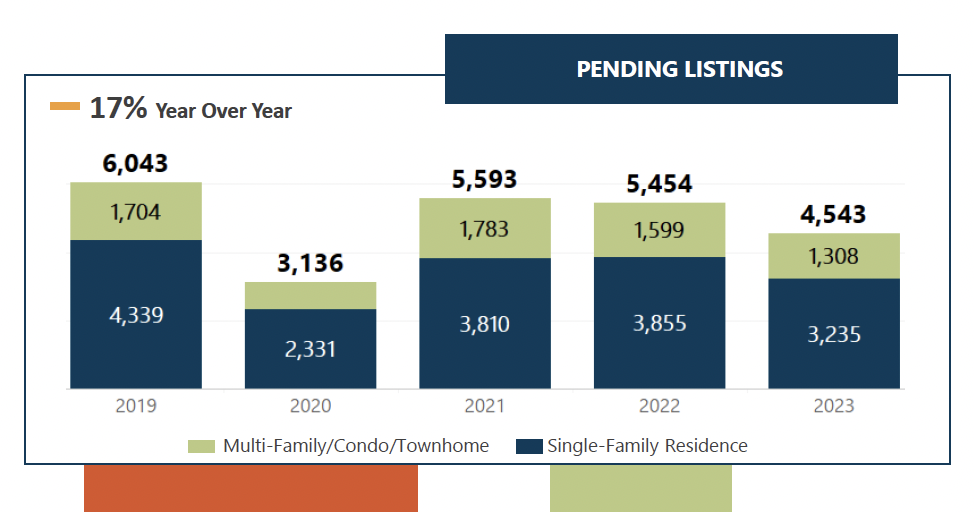

- Pending Homes Under Contract Year over year in May are 22.1% lower in 2023.

- Average Price of a Home from April 2022 to April 2023 is down 6.9% to $673,547 in 2023.

The market is moving from a record year does not make 2023 a bad year and would best be described as a normalizing or flattening year of sales. The first part of 2022 was off the chart crazy for real estate with bidding wars and increased prices above list price so when you compare year over year, it may sound awful, but the numbers really are showing an uptick of sales is about to occur before the end of 2023.

- Active inventory rising is a common occurrence in spring real estate in Denver. In fact, it is growing at a slower rate than you would expect for springtime listing inventory, primarily because most homeowners that have low interest rates for existing mortgages are not entering the market. With inventory remaining at historically low levels and the supply of inventory being at a 38-day supply as of May 15, 2023, sellers will still have some negotiating benefits when there is no competition.

- Pending Contracts are future predictors of real estate closings. Pending Contracts are down 22.1% year over year, however, comparing this current pending total with May of 2022 most certainly suggests fewer closing for the next 60 days compared to 2022. With that said, this Pending contract total will level out over the next 90 days, meaning 2023 will show approximately the same number of buyers in August, September and October and potentially could see an increase of buyers if rates drop below 6%.

- Average Closing price from April 2022 to April 2023 is what the media will focus on as being a bad market regarding the price of homes. Currently the average price of a home in Denver is $673,547 which is 6.9% lower than April 2022 according to REColorado. This is really a misleading number, as April of 2022 had a average sale to list price of over 6% over list in Denver County. I used $500K to $750K to give an overall view of how much buyers overpaid list price in April 2022 as their system will not allow all 5100+ closings to be tracked. With that overage of buyers willing to overpay, today’s prices are almost identical to list prices in 2022. Hence, if sellers are smart and motivated, they will look to pricing their homes in a position that does not include the 6% increase buyers incentive to sellers in 2022. I’ve attached that snap shot data for your reference I made here.

- April of 2022 had 5157 Single Family and Attached homes close and in 2023 the single family and Attached homes total closings were 3814. We had 3% interest rates in April 2022 that were locked in from February and March 2022 time frames and in 2023 we have dealt with approximately 6.5% 30-year fixed rates. This slows buyer behavior quickly when payments more than doubled in 12 months. We predict the rates will drop below 6% in late June into mid July and you will see a rush of buyers to the market similar to what happened in the last 10 days of January 2023 when rates went to 5.875% for a brief time.

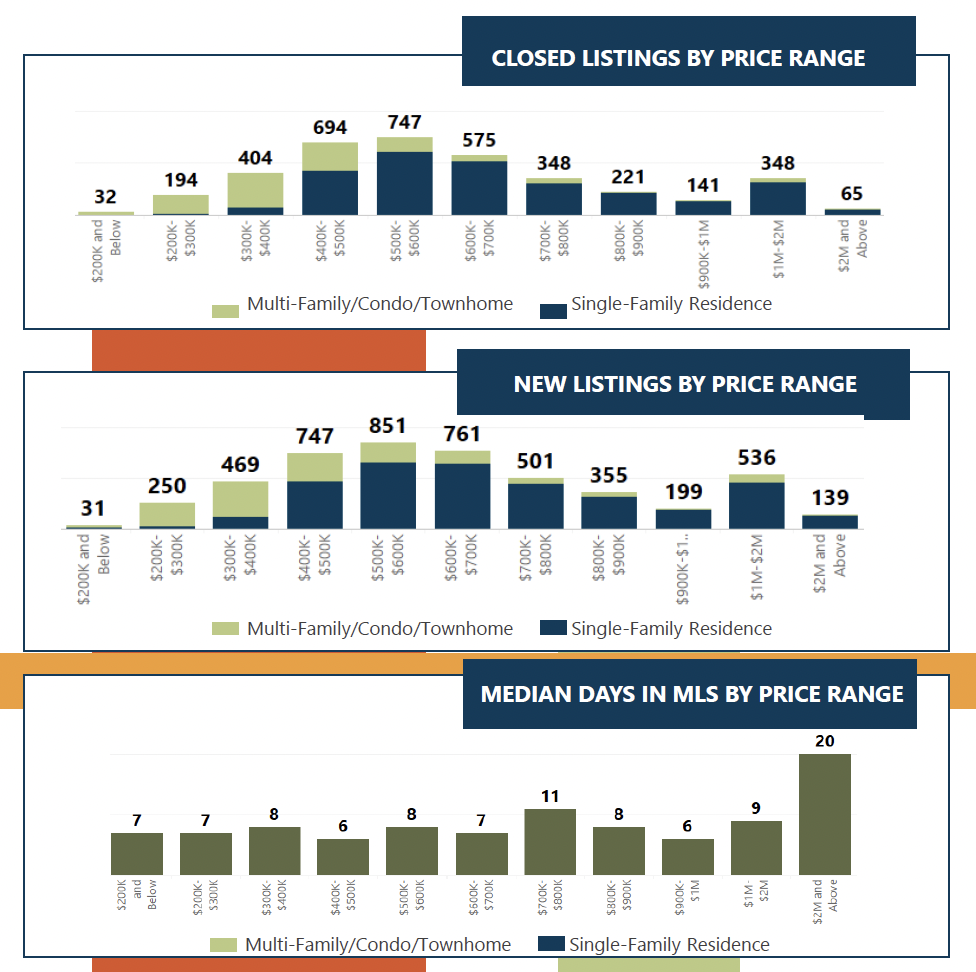

- Median Price is a result of the mix of business that occurs at that moment. This does not mean prices have dropped 7%, just the mix of business is at lower levels by 7%. In other words, higher priced properties are slowing down in the number of sales that occurred compared to 12 months ago.

These stats all suggest that when interest rates come down about 10% off of the 6.5% of today, there will be another buyer rush to the market creating a mini buyer frenzy for the few homes available.

- Get into the market now when there are fewer buyers competing for properties and get pre-approved to move now.

- Lock your rate and try to set a closing date for 60 days out from now. Work with a lender that will provide your clients a “Lock and Lower” rate if the rates do come down. Right now, some sellers are still willing to pay for a 2-1 buydown and it could be a windfall for a buyer if the rate went down to 5.99% by July. FHA and VA rates have hovered below 6% in recent weeks and consider utilizing those terms.

- Buyers have negotiating leverage with inspection objections in today’s market. Another reason to buy now.

- Working with a Lender with flexible underwriting terms for buyers will make your buyer more comfortable to buy.

- Entering the market now gives sellers an opportunity to be found by buyers as there are not many homes for sale. However, sellers need to position their home 6% lower when utilizing comparable sold data for the last 12 months to determine a price position to be most competitive and sellers may not feel comfortable doing this. However, “Smart Seller Price Positions” are what beats the Odds of the market to sell. This will allow the seller to beat the market and in so doing, removing the typical terms the sellers are willing to offer today such as buydowns and even improve their negotiating position for inspections.

- Get your home in move in condition. Fewer buyers in the buyer pool will be more demanding of condition.

- Be patient as the last 3 years have had homes sell quickly, and now we are over a month supply, meaning it could take 45 days to 60 days to find the “Right Buyer” for your home.