2022 Annual Update

&

2023 Real Estate Review!

Jack discusses the 2022 Real Estate Review and 2023 Predictions

2022 Sold by O’Conor!

2022 Actuals

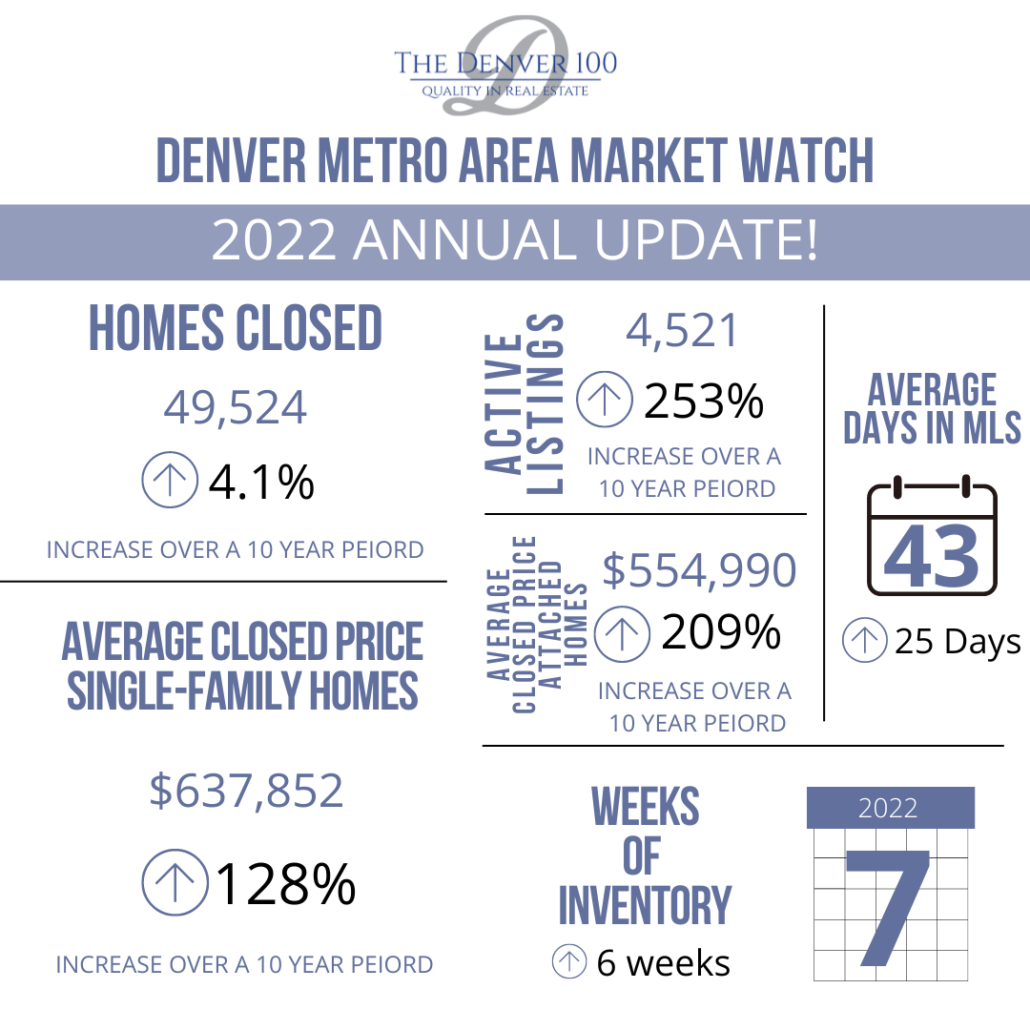

- 2022 year end had 4,521 active homes for sale vs. 2021 year had 1,282 homes – an increase of 253% of inventory over last year

- Average price of a home ending 2022 is $637,852 for single family sold vs to $622,740 ending 2021 year, which is an 2.4% increase in price for the mix of properties sold

- Average days on the market was 43 in 2022 vs to 18 one year ago.

- The selling price obtained compared to List price ending 2022 at a 98.6% to listing price and 2021 ended at 101.22% above listing prices

- The absorption rate for single family homes in the Denver Metro Area ending 2021 year-end inventories was a 1 week supply vs 2022 that absorption rate is now 7 week supply of homes!

- The $500,000 to $750,000 price range had the most detached home sales with 17,127 homes closed in 2022 creating an absorption rate of 4.2 weeks of inventory

- The $1.5 million and above price range had a total of 1,781 homes closed in 2022, creating a current absorption rate of 15 weeks of supply. This is an increase of 388% in absorption rates from 12 months ago. Luxury Home Sales in the Denver metro area are most certainly slowing down in demand.

2023 Predictions

-

2023, we do see a slight price adjustment downward in housing due to interest rate and prices still above the affordability of most buyers. The price reduction will be modest for some of the upcoming trends below, but sellers will have to be more realistic in their approach to setting their price. Remember, any prices retained in 2022 that offered bidding wars, removal of terms or forfeiture of funds did not establish new market value highs, but did have buyers willing to overpay to obtain a home in that market. Seller’s will need to consider accepting contingency terms and not set their expectations on aggressive bidding war prices that zealous buyers used to be the winner of the purchase of the home early in 2022, but still fresh in homeowners minds. These did not set values, but did establish a singular buyer to create a higher net to the seller to get the seller to accept their offer. Look to a 5-6% decrease in average pricing in 2023 on true 2022 market values, not inflated values.

2. Interest Rates have soared the early part of the second half of 2022 and will level off in 2023. We see trends for interest rates to hover around 5.875 to 5.99% in the spring of 2023. This is about a point lower off of the high level and historically lower than the lifetime average of rates. However, we have a full decade of buyers who have not experienced rates at this level and creating short term pathways of buy downs or seller concessions on closing costs plus seller concession for inspection objections will ease the pain of rates for the buyer pool.

3. Inventories will grow slowly, unless a seller is in a “need position to sell” you will see more sellers stay put and not enter the market. The thought that buyers should wait for lower rates and more homes becoming available will probably not occur in this decade. Why? Over 25 million homeowners have an existing 3% or lower mortgage rate on their home and unless they find themselves in one of the primary reasons to sell, such as, relocating to a new area, loss of job or obsolescence of the home, the normal homeowner will enjoy a low house payment and sit on their equity until homeowners actually need the money then they will sell. With supplies staying relatively low in relationship to demand, prices will not retreat and stay within 95% of today’s value.

4. Affordability of homes will bring new programs and governmental entities to the real estate table in 2023. What you will see are cities offering down-payment assistance programs for first time home buyers, educators and first responders. These municipal programs attract buyers to their cities. Secondly, you are liable to see more governmental oversight on land to create affordable housing. Cities and Counties will utilize new attractive down payment and lowering of interest rates programs for affordable housing programs to attractive specific groups, like teachers or first time home buyers to their areas.

5. New Construction has not kept pace with the demand of buyers wanting new homes and will lag behind in 2023 for inventories creating a price stability in housing. There will always be some standing inventory in a shifting market, and this is a good time to buy a new builder home, but these inventories are absorbed very rapidly and 2023 will be another year of writing a contract and waiting for the home to be finished as a buyer.

6. Home Designs and Workers location to their employment will create movement in housing next year. The workforce will go back to work in 2023 for at least 3 days per week and the two family designed homes will continue to grow in numbers as parents and children decide to split the higher costs of housing.

7. The standard for supply and demand to create an equilibrium in buyers and seller has historically been identified by economist as a 6 month’s supply. We would suggest that with the increase in the prices of homes over the last 5 years and the result of lower inventories predicted, a 3-4 month supply will be closer to a balanced market where buyers and sellers are in an equal negotiating position.

All Data is taken for ReColorado on January 15th, 2023.