The O’Connor’s provides this Annual Real Estate Report as a service to our clientele and friends to give the current trends in the Denver residential real estate market and a resource to predict the future housing direction in our marketplace.

Greater Denver Metro Area Communities

Arapahoe, Adams, Boulder, Broomfield, Denver, Douglas, Elbert, and Jefferson

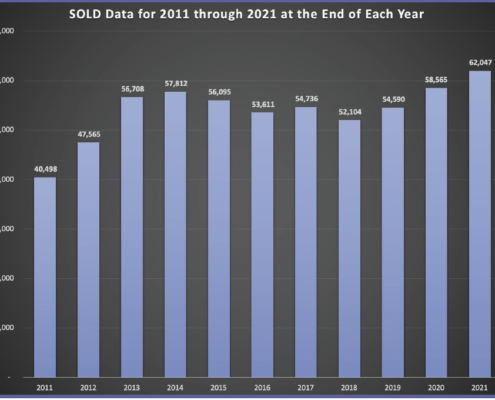

62,047 single-family and condominiums sold in 2021 compared to 58,565 sold in 2020, or a 7.3% increase in the number of homes closed.

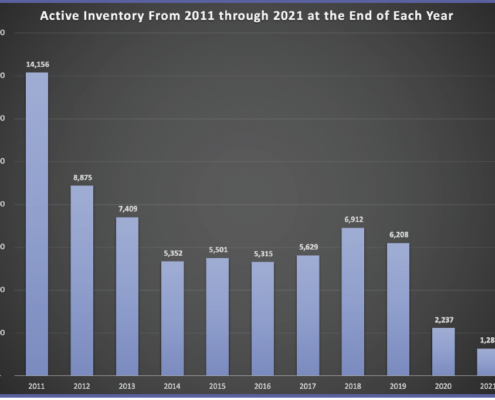

• At Year-End 2021, there were 1,282 active homes for sale compared to the end of 2020, which had 2,956 homes – a decrease of 57% of inventory over last year this time. This decrease does suggest the sellers in the Denver real estate market are still at an advantage in negotiating their sales as prices are still rising.

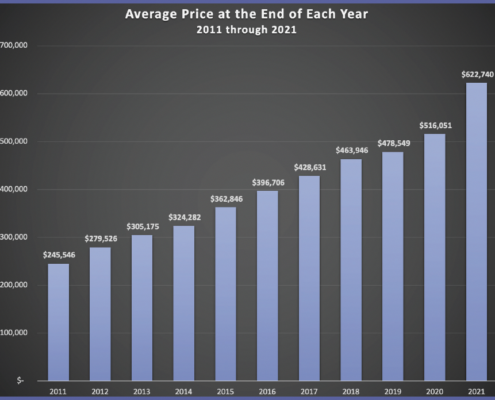

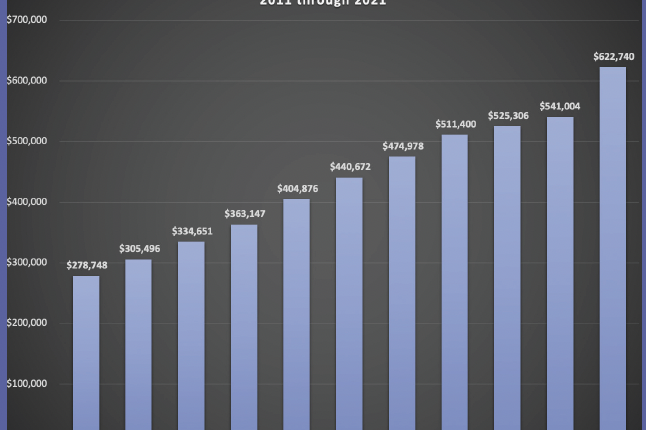

• The average price of a home in the Denver Metro Area ending 2021 is $622,740 compared to $541,004 ending 2020, a 15% increase in price for the mix of properties sold. By comparison, 2010 had a single-family average price in Denver of $258,597.

• The average days on the market for 2021 was 18 compared to 24 one year ago.

• The selling price obtained compared to the List price is above 100% for most neighborhoods in Denver.

• What this means is that buyers were willing to pay more than full price to buy a home in 2021.

• The absorption rate for single family homes in the Denver Metro Area with 2021 year-end inventories is a 1 week supply. As the inventory increases the amount of supply increases. This inventory monthly supply will rise during the spring and summer seasons.

• The $500,000 to $750,000 price range had the most detached home sales, with 19,492 homes closed in 2021, creating an absorption rate of 6 days of inventory. Below 6 months of inventory typically indicates prices will continue to increase.

• Conversely, the $1.5 million and above price range had a total of 1586 homes closed in 2021, creating a current absorption rate of 1.05 months of supply. This is a decrease of 62% in supply from 12 months ago. Luxury Home Sales are on Fire in Denver.

Do You Wish You Would Have Bought More Real Estate in 2011?

Don’t wish the same thing in the year 2030!

Watching the inventory will give you a very visual picture of Denver’s future real estate performance. In the last decade, inventory has decreased from 14,156 in December of 2011 to 1282 in December 2021, a dramatic 91% decrease from that date. This has made the Denver real estate market one of the most outperforming markets compared to other national marketplaces. We see inventories growing slightly year over year by as much as 400% in 2022 to an inventory level of approximately 6000 units available at the peak of the spring/summer selling season. However, until the inventory rises above the 15,000 unit level, the demand for housing will remain strong.

Total Number of Homes Closed Increased 53.2% over the last Decade!

In the recent ten years of data, the number of units closed has gone from 40,498 in 2011 to 62.047 in 2021. This increase in closings represents a 53.2% increase in closed units over that period. As the inventory will rise in 2022 and beyond, the number of units closed will decrease slightly over the next 5 years as buyer demand

decreases. This growth is unsustainable to continue, even though we expect population increases in Denver for future years. Builders have built out on their past lots, leaving very little standing inventory. We anticipate new home “starts” to continue to rise in Denver. The resale number of units closed indicates the short term will not see very much of a decrease in the number of closed units for 2022. However, due to the lack of current available resale inventory, we see an adjustment of the number of units closed in 2022 to be 6% less than 2021, or

approximately 58,324 homes closed for the upcoming year.

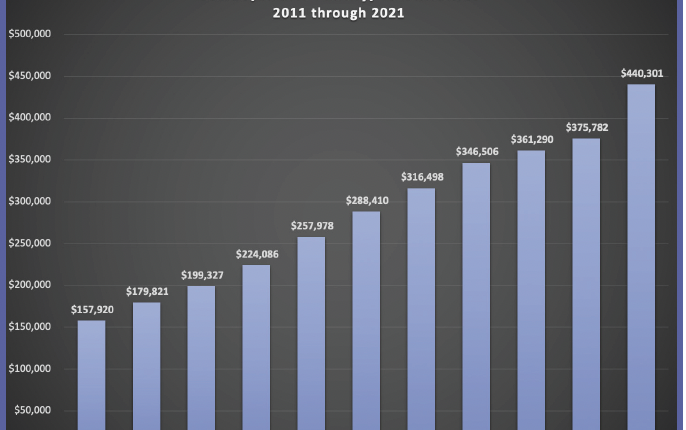

Average Price went up 154% Since 2011

A 154% rise in the average price of all properties in Denver for the last decade makes homeowners very happy with their newfound equity position. This wealth growth in housing for Denver is unprecedented and cannot be sustained due to the average buyers’ income that has not kept pace with the property pricing for the 8 county Denver metro area. Homeowners, on average, have more equity today than ever before in Denver. That equity position is causing homeowners to stay in their existing residences vs. making a move within the market. 2022 will find retiring property owners selling and taking advantage of the growth of their assets and making a move to less expensive markets. Most homeowners move towards the locations of their families. Since many property owners in Denver moved to the Colorado market for opportunities, they are often displaced from their core family location. Equity in homes gives the flexibility to consider a move.